September 10, 2020 · Melissa Kavanagh

Fuel COVID-19 Consumer Sentiment Study Volume 9: More People Are Traveling Than You Think

We hope that you find the information useful. The survey was sent out on August 27, 2020, and received 1,800 responses. Below is a summary of the findings, along with some observations and opportunities that arise from the results.

Executive Summary

Confidence in travel has continued to rebound since our last survey, and is nearly at the level we had seen in June. We asked new questions to those who have traveled during the pandemic. We also broke down the data based on age groups (Gen X and younger vs. Boomers and older). Below are the key points of this survey.

- Half of the respondents have traveled since the pandemic.

- Of those who have traveled, more than 30% made last-minute trips.

- Communication to guests about the status of local restaurants, attractions and activities has been sub-par.

- On-property cleaning/sanitization generally has been meeting or exceeding expectations.

- There was another big shift in sentiment about mask ordinances, with less people being neutral on whether a mask ordinance will affect their decision to travel to a destination.

- Open air destinations and 1-3 hour drive locations are still far more likely to be visited in the near future.

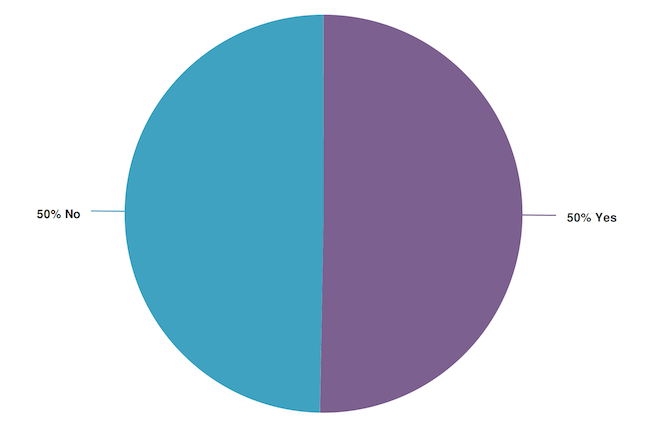

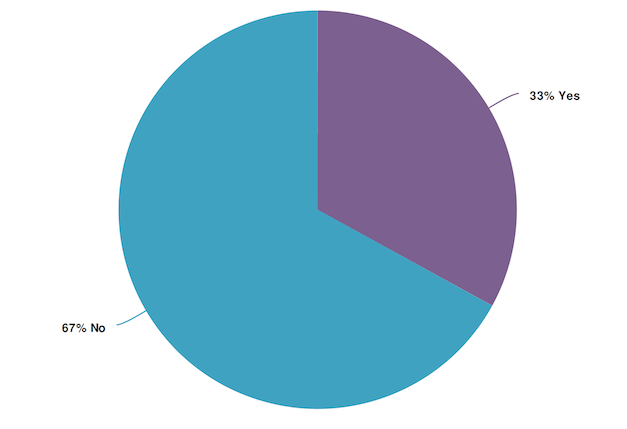

1. Have you traveled since March 15th, 2020?

- Observation: 50% of respondents have not traveled since COVID-19 was declared a pandemic!

- Age Comparison: 57% of the Gen X and younger group of respondents have traveled.

- Data Comparison: In our last survey, 34% of respondents had traveled. We suspect that in our next survey that will come out after Labor Day, these numbers will have risen even further.

The next four questions were only asked to people who responded ``yes`` to the previous question.

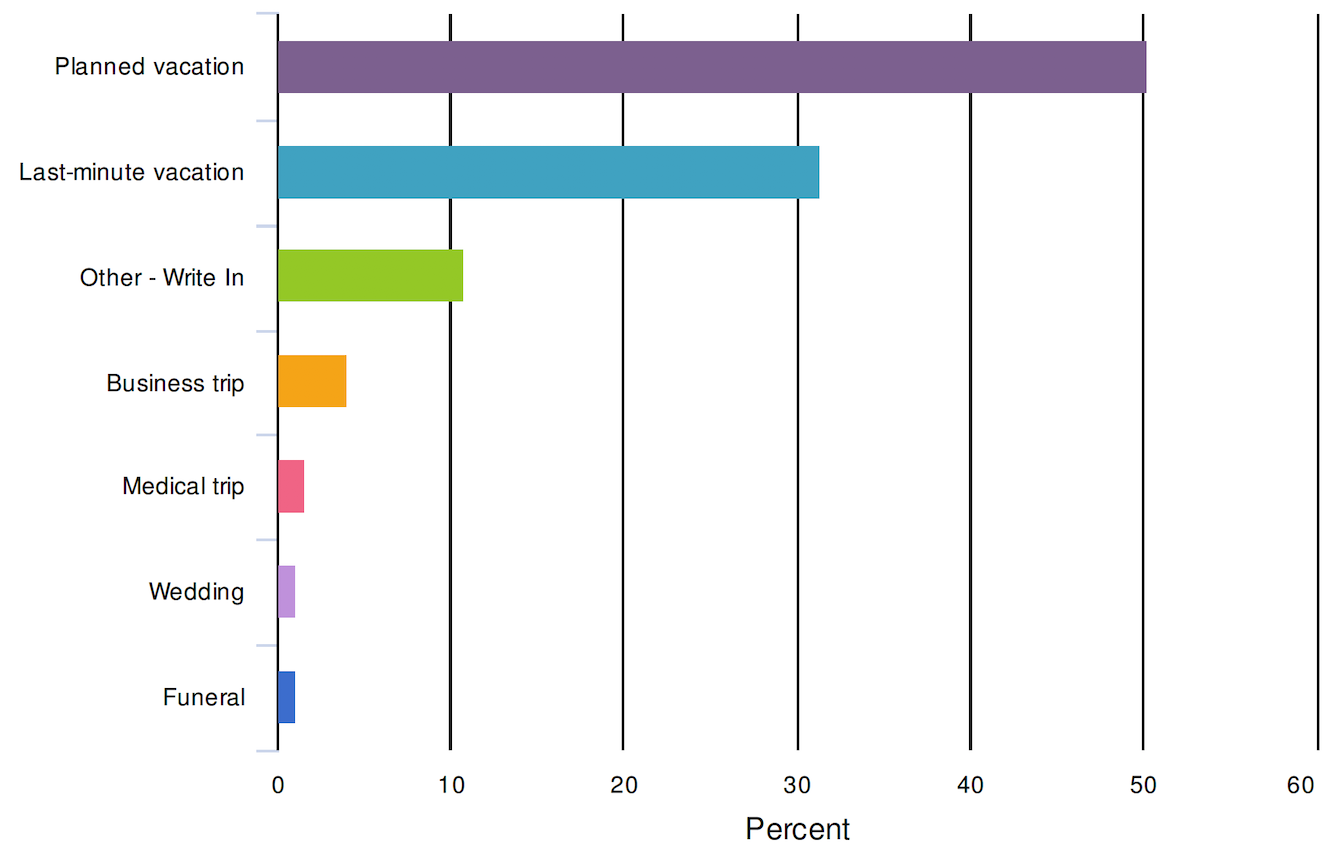

2. What was the reason for your recent trip?

- Observation: 50% of consumers traveled on a planned vacation, over 30% for a last-minute vacation, and the majority of write-in answers were for visiting family.

- Opportunity: Combining the fact that so many people had gone on last-minute trips, with the data showing the likelihood of traveling 1-3 hours from home shows enormous opportunity for drive-market consumers.

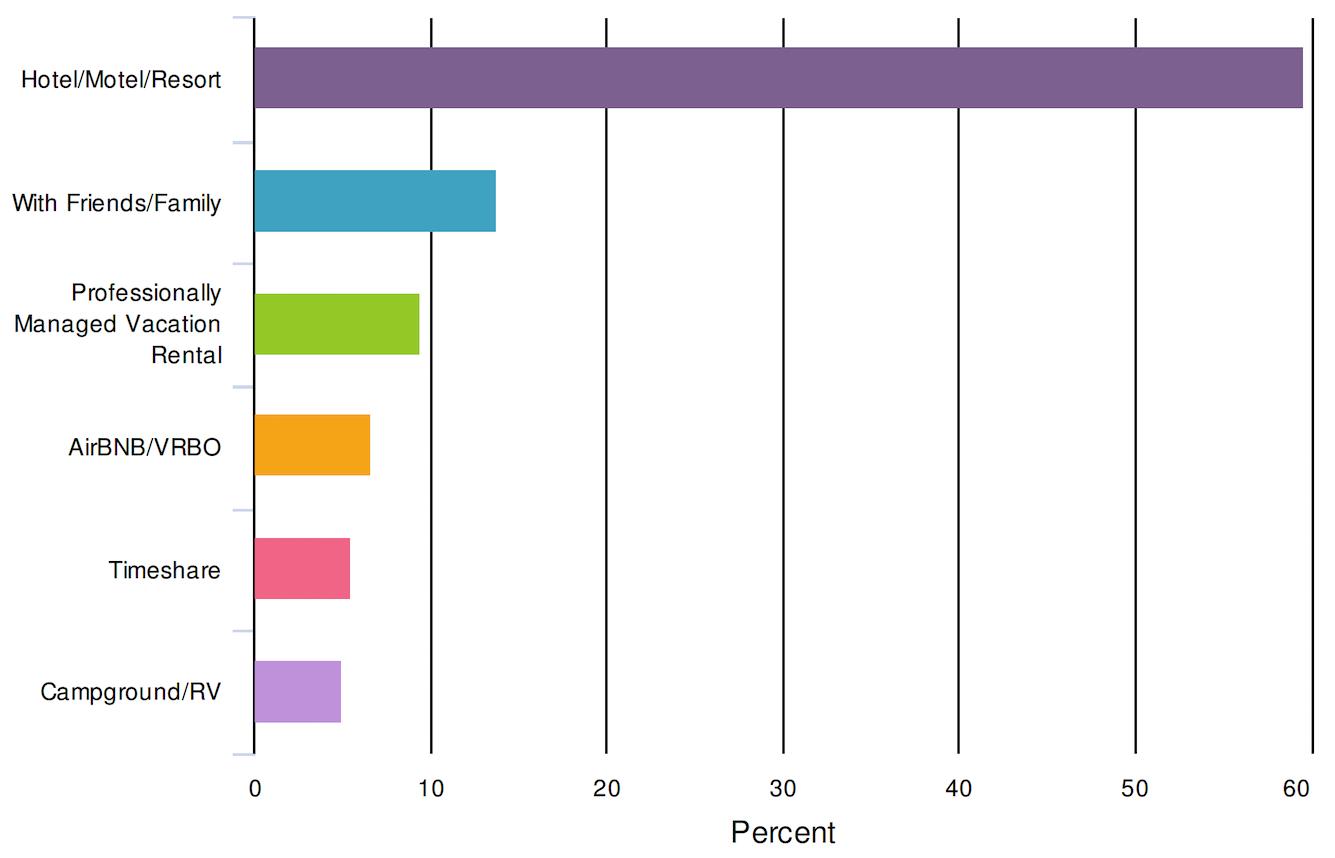

3. During your recent trip, where did you stay?

- Observation: Nearly 60% said they stayed at a hotel-type property. No other property types came remotely close to the popularity of hotels.

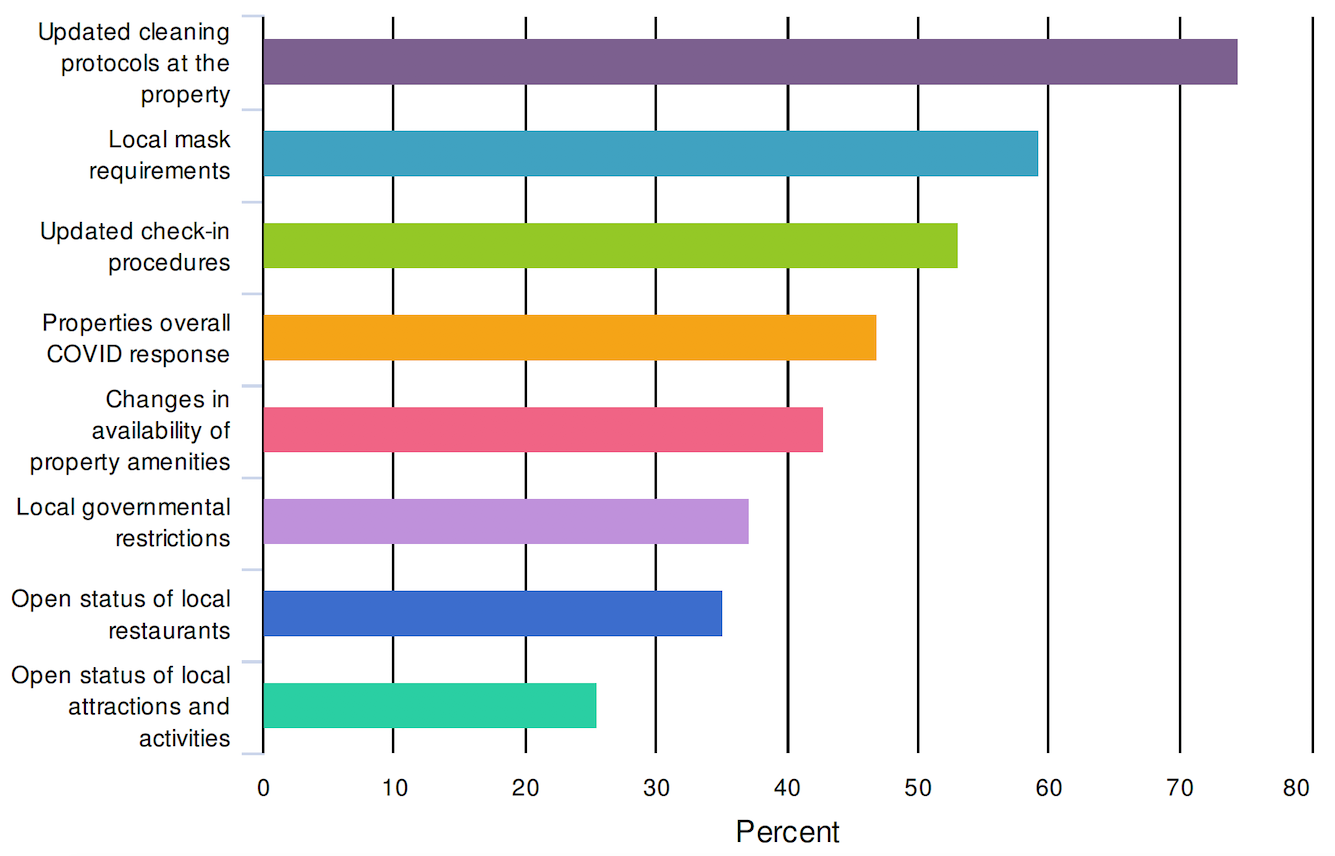

4. Did the property communicate the following to you prior to your recent stay?

- Observation: 75% of respondents said that they received communication regarding cleaning protocols at the property, and nearly 60% for local mask requirements. Properties are not communicating well the status of local restaurants or attractions/activities. Only 25% knew the status of local attractions before arriving.

- Opportunity: You can, and should be, a great source of information as it pertains to your local area. Always have updated information on your website and in all communication to guests on the status of restaurants and local attractions. Remember that the hotel room is just one part of a guest’s vacation.

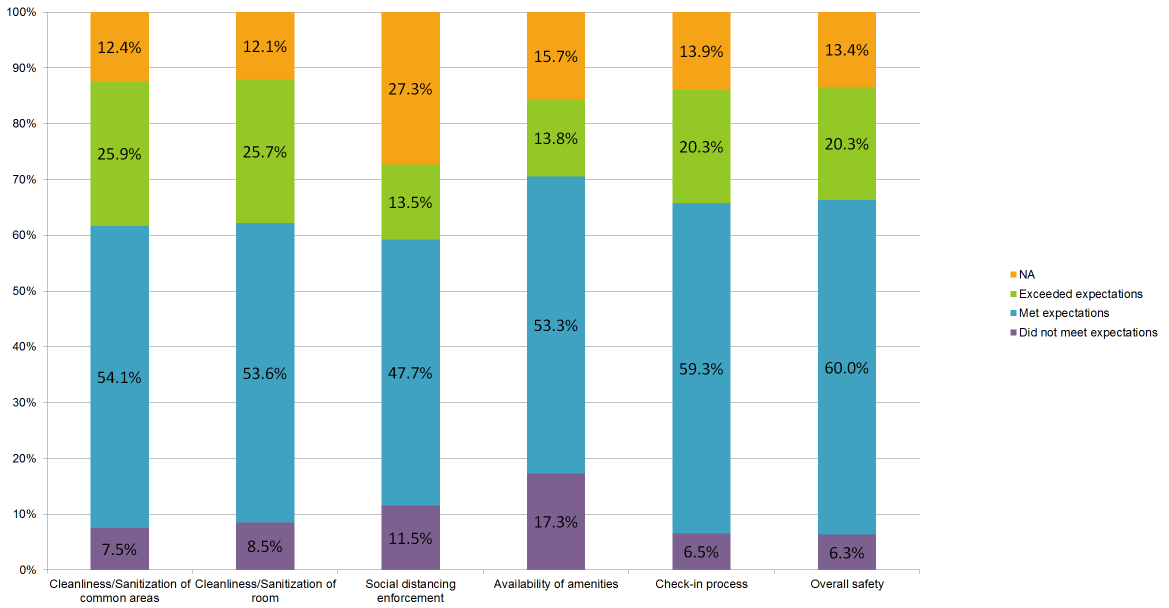

5. Did the property meet your expectations in the following areas?

- Observation: Great news for hoteliers! In every area, an overwhelming majority of respondents said their expectations were met or exceeded! The two areas with the most dissatisfaction were social distancing enforcement (12%) and availability of amenities (17%).

- Data Comparison: Almost across the board, percentages for not meeting expectations decreased, and those with expectations exceeded increased several percentage points. Those saying that social distancing enforcement did not meet expectations decreased from 17% to 12%. However, dissatisfaction about the availability of amenities increased from 16% to 17%.

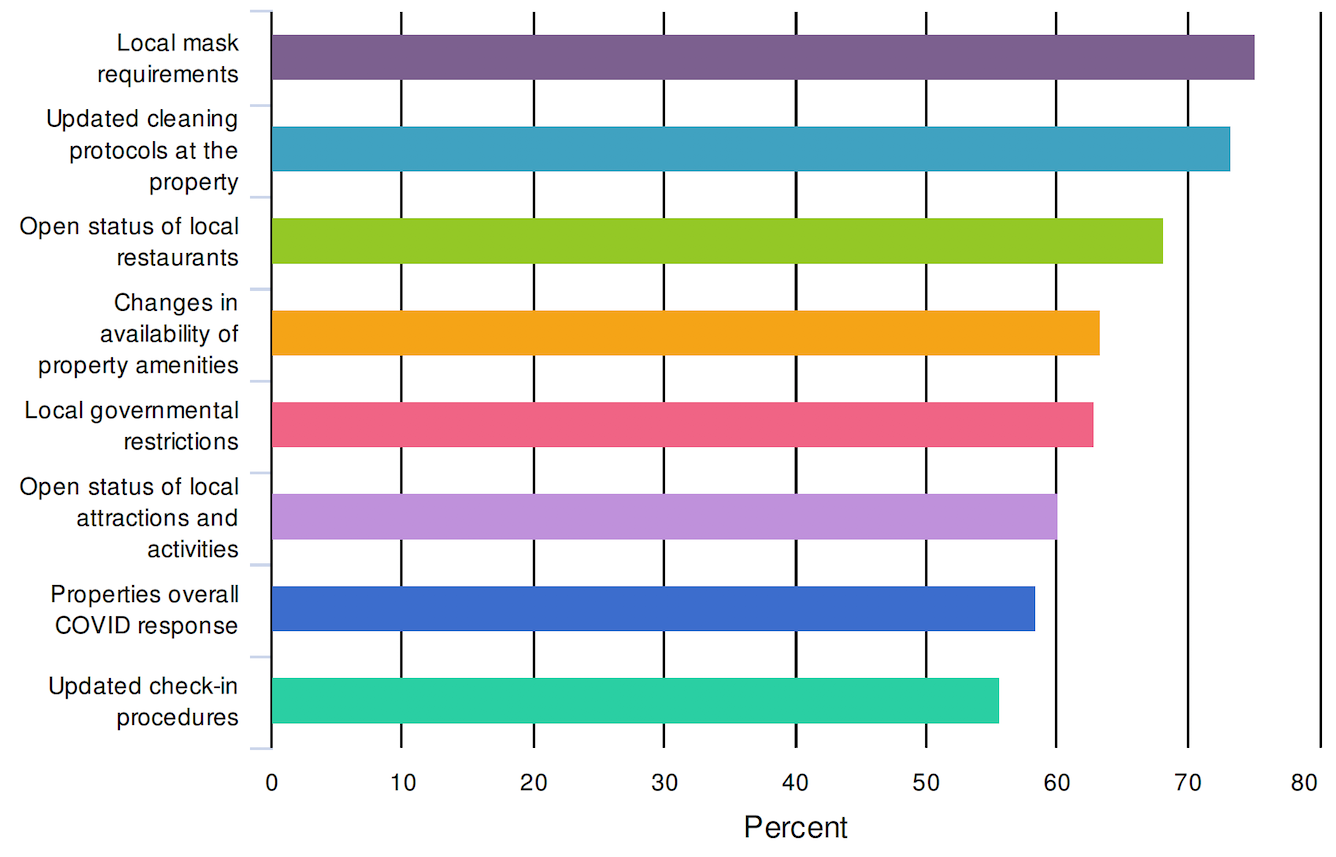

6. The next time you travel, which of the following would you want the property to

communicate to you prior to your stay?

- Observation: 75% of respondents want to know local mask requirements, closely followed by cleaning protocols at the property.

- Age Comparison: Those in the younger age groups ranked the open status of restaurants and local mask requirements equally at the top of the list, with 70% each.

- Opportunity: Nearly 70% WANT to know the status of of local restaurants, but just 35% of consumers have received this.

- Resource: We’ve covered some ideas on how to convey this information.

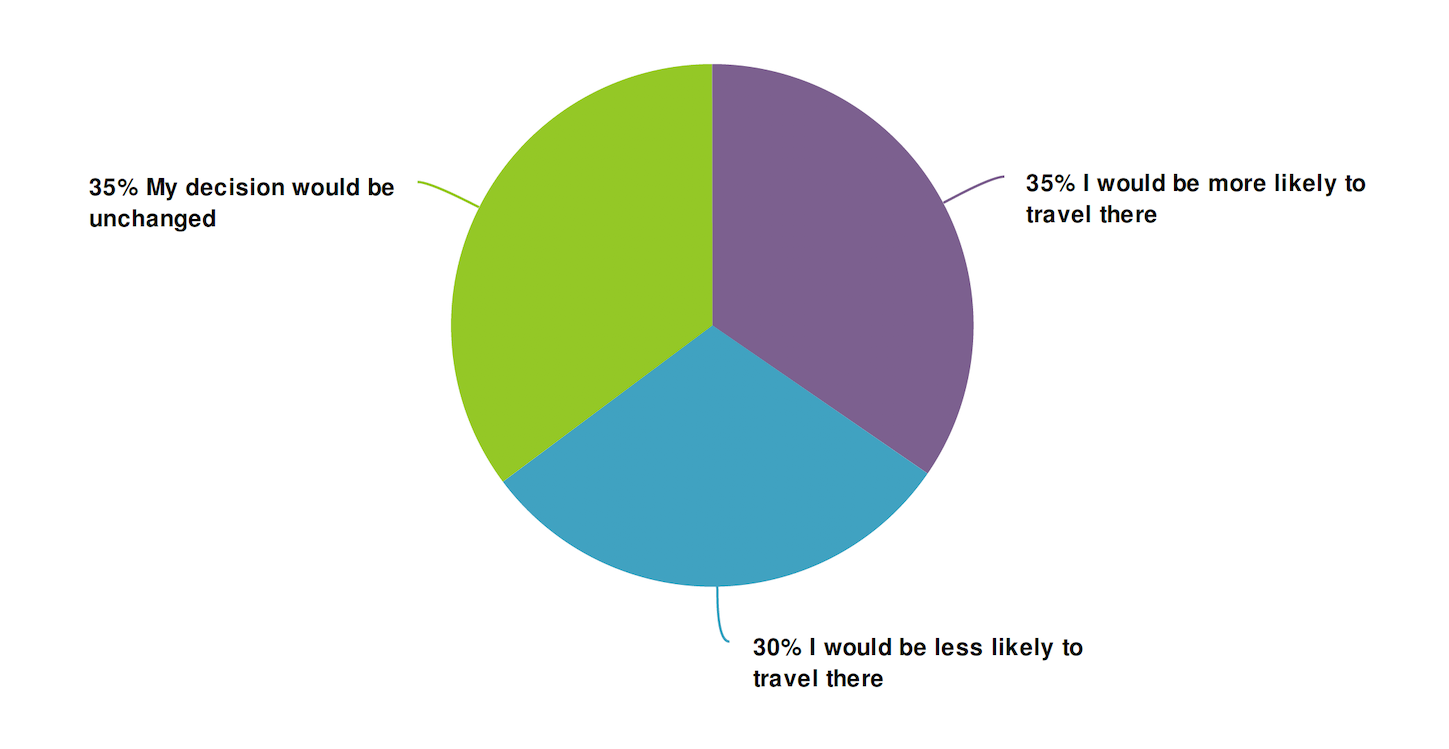

7. If your desired destination implements a mandatory face mask ordinance, how will

this impact your travel plans?

- Observation: Responses were nearly evenly split.

- Age Comparison: 43% of those in the younger group would be less likely to travel with an ordinance in place, vs. 23% of those in the older group.

- Data Comparison: Those voting positively for mask ordinances remained at 35% since the last survey, however those with unchanged decisions decreased from 46% to 35%, and those less likely to travel increased from 19% to 30%.

- Opportunity: It is important that your property take a stand on this issue, and follow through. Being clear in your expectations of guests’ behavior rather than being wishy-washy, and enforcing those expectations is important, as we saw previously from those who have traveled this year.

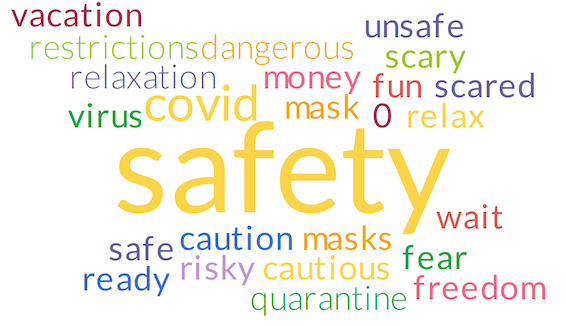

8. What is the first word that you think of when considering travel right now?

- Observation: “Safety” remains the most popular word.

- Data Comparison: “Mask” and “masks” have made their third appearance. “Scary,” “risky” and “dangerous” remain at the same size we’ve seen through the last few surveys. “Freedom” has returned.

- Opportunity: People are concerned for their safety above all, but they are also craving relaxation. What can you do to ease their mind about traveling to your property, with their budget concerns in mind?

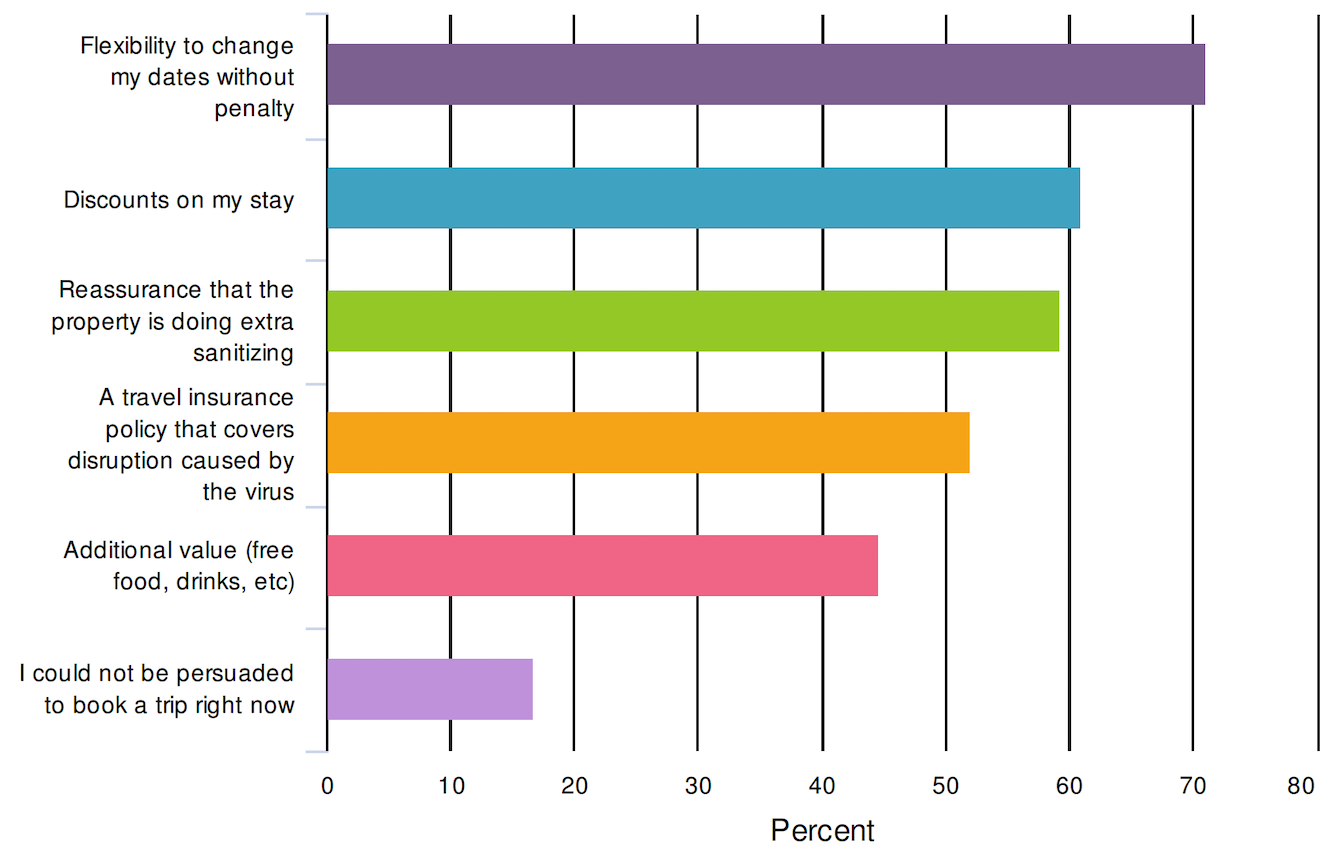

9. Which of the following would most likely persuade you to book a future vacation during the coronavirus outbreak? (Check all that apply)

- Observation: Over 70% of people chose flexibility to change without penalty.

- Data Comparison: People saying that they could not be persuaded decreased again, going from 22% back down to 16%. This is now back to being the lowest percentage we have seen during these surveys.

Discounts on stays and reassurance of extra sanitizing continue to jockey for position with each round of the survey, with discounts marginally beating out sanitization on this iteration. - Resource: Fuel put this article together on what types of policy changes and messaging you should be implementing right now: The Definitive Guide To COVID19 Policy Updates & Communication.

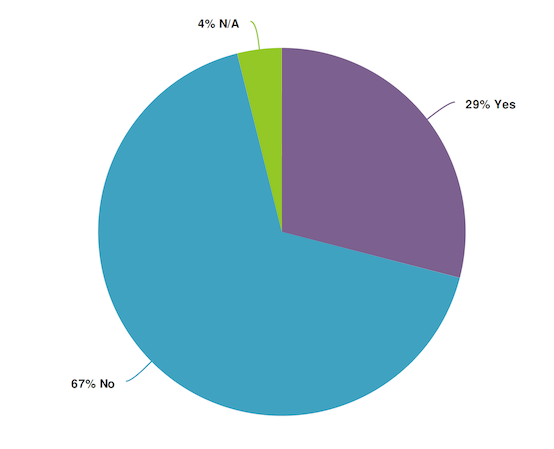

10. Have you already booked your future stay?

- Observation: 29% of people do have an upcoming stay booked, 67% do not.

- Data Comparison: These percentages have fluctuated with each survey, ranging from 60%-65% saying they do not.

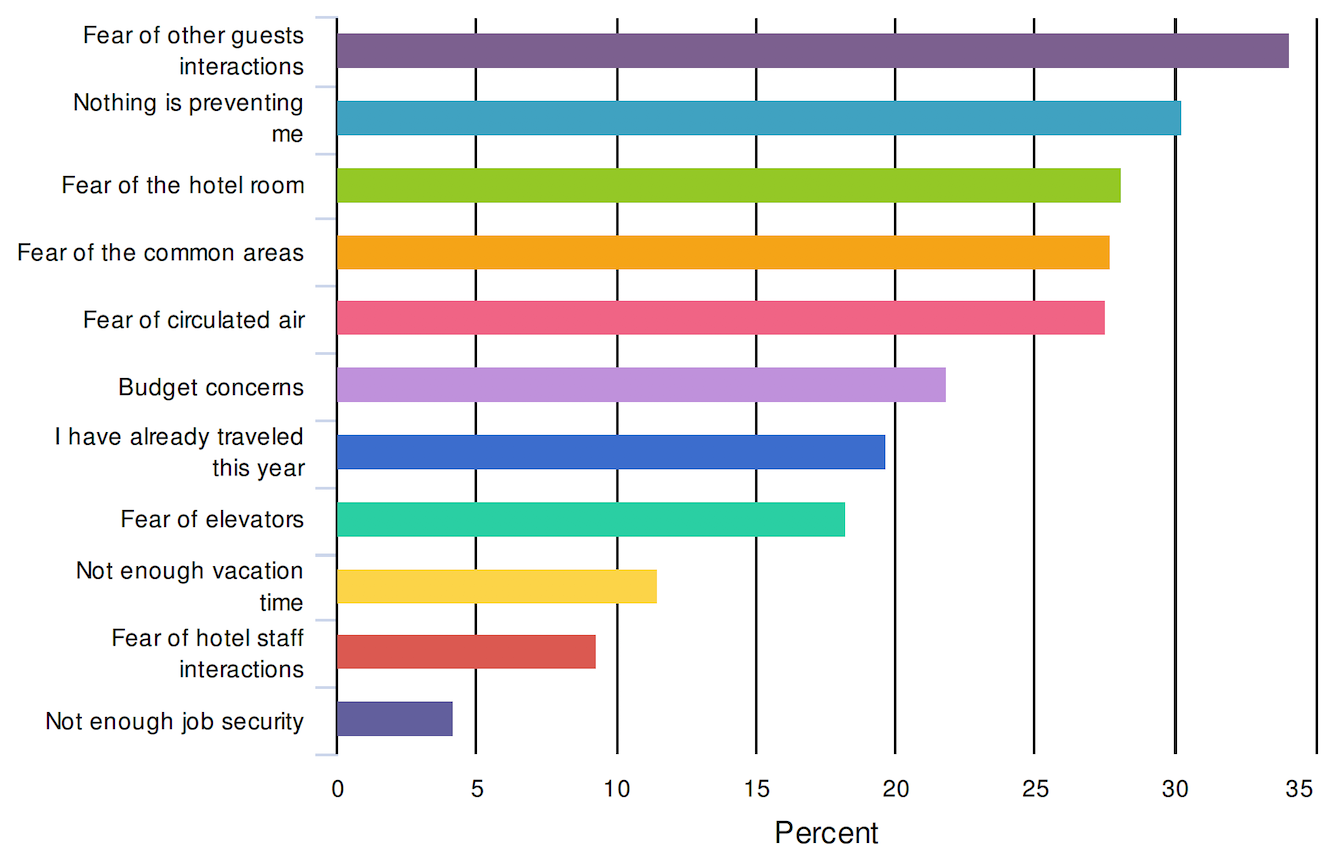

11. Pick the top 3 reasons that would prevent you from staying at a hotel right now.

- Observation: Fear of other guests interactions remains the top concern, with nearly 35% of respondent votes.

- Age Comparison: “Nothing is preventing me” was the top choice for the younger group, with 36%, followed by “budget concerns” at 32%, and then “I have already traveled” at 27%.

- Data Comparison: “Nothing is preventing me” has moved into the #2 position, with 31% of respondent votes, and an increase of 7 percentage points since our last survey. The percentage of fear of guests decreased from 46% to 33%. Fear of the hotel room moved into the #3 spot, barely above fear of the common areas.

- Opportunity: Be clear with all of your messaging and website information as it pertains to the cleaning procedures on property. Additionally, communicating the status of property amenities, and area attractions and restaurants is extremely important. If your primary consumer is those with children, being mindful of their budget concerns will also be important.

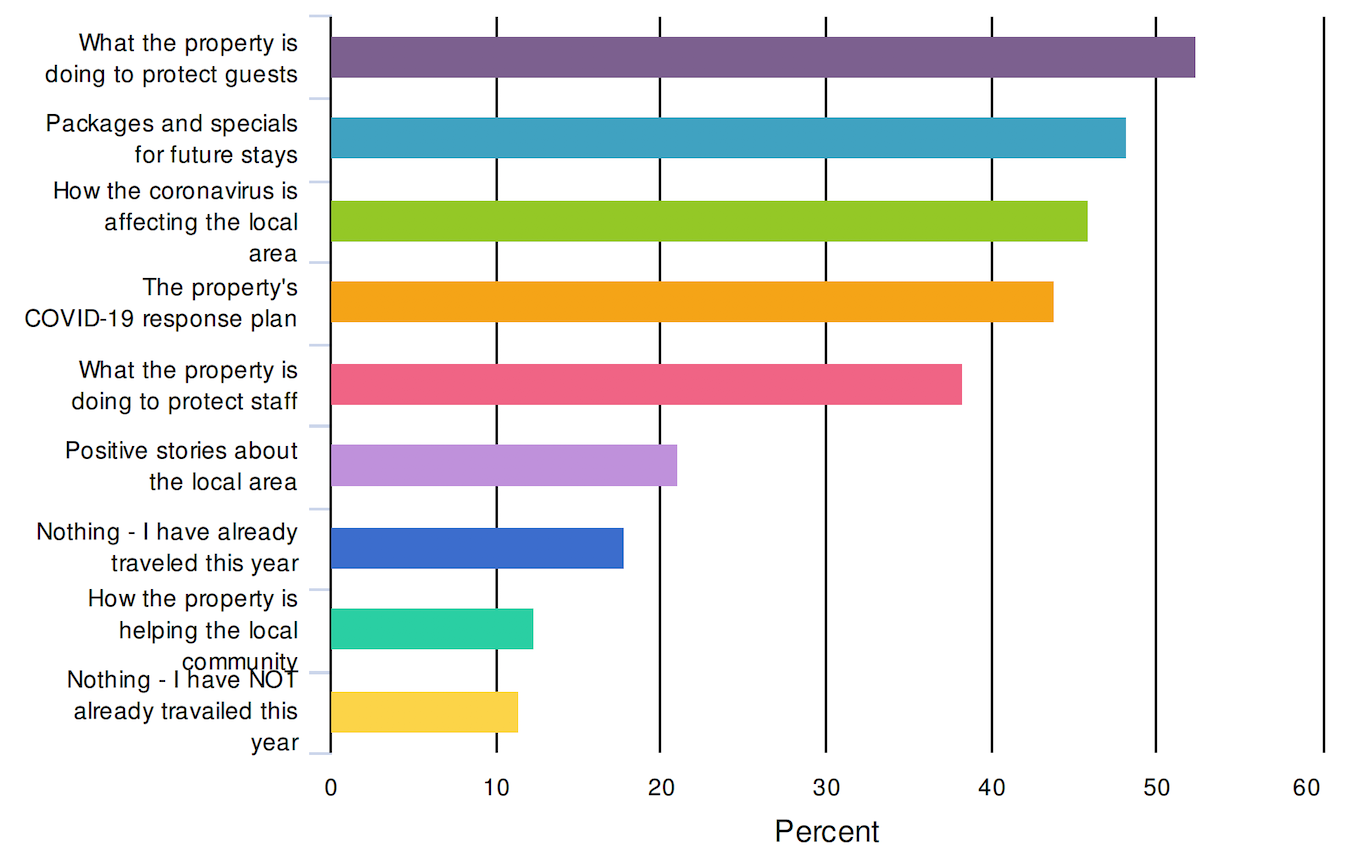

12. During the outbreak, I would like to hear from hotels on the following topics: (check all that apply)

- Observation: Respondents continue to be more interested in learning about what properties are doing to protect guests than they are about receiving deals for future stays.

- Data Comparison: Most data has had very little shift since the last survey. However, those saying “nothing – I have already traveled” and “nothing – I have not already traveled have shown some movement. Those who have already traveled increased from 11% to 18%, and from #8 to #7. Those saying that they don’t want to hear from hotels even though they haven’t traveled decreased from 15% to 11%.

- Opportunity: For those consumers that want to hear from hotels, sending messaging with important information on their safety AND that provides value to them, and shows empathy, can keep your property top of mind.

- Resource: Having the right CRM system is critical to this success. Find out how to determine if you are ready for a new one, and for the best strategies for using your system to its fullest ability. Your CRM System Will Determine How (and if) Your Hotel Recovers From COVID-19

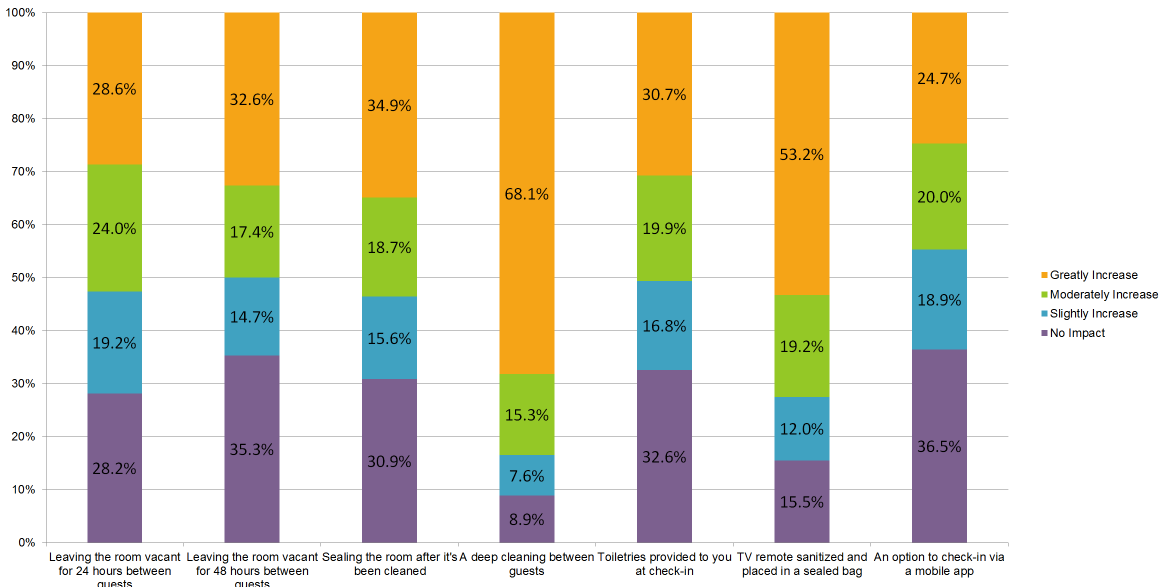

13. How would the following hotel protocols increase your confidence in staying at a

property?

- Observation: Deep cleaning between guests, and placing the sanitized remote in a sealed bag had the biggest impact, with 68% saying deep cleaning would greatly impact confidence, and 53% for the remote.

- Data Comparison: All tactics, across the board, had a higher percentage of votes for no impact than the last survey.

- Opportunity: Be crystal clear in your communication to guests and potential guests about cleaning protocols. Additionally, with the remote having such a strong response, if you are able to incorporate this small item into your operations, it would be of great value to guests.

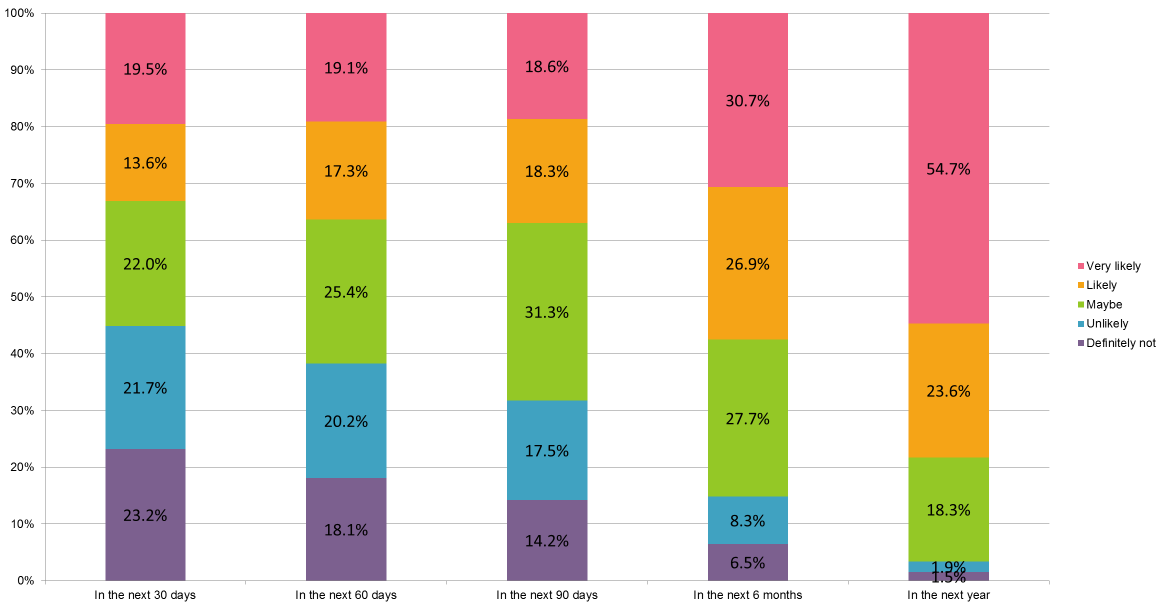

14. How likely are you to book a trip:

- Observation: 55% of respondents answered “maybe” or higher within the next 30 days. 62% responded for the next 60 days, and 68% for 90 days.

- Data Comparison: We saw an increase in those answering at least “maybe” in the next 30 days, going from 45% to 55%, which puts us almost back to the high of 57% we had seen three surveys ago. When we first asked this question on April 16, 37% responded at least maybe.

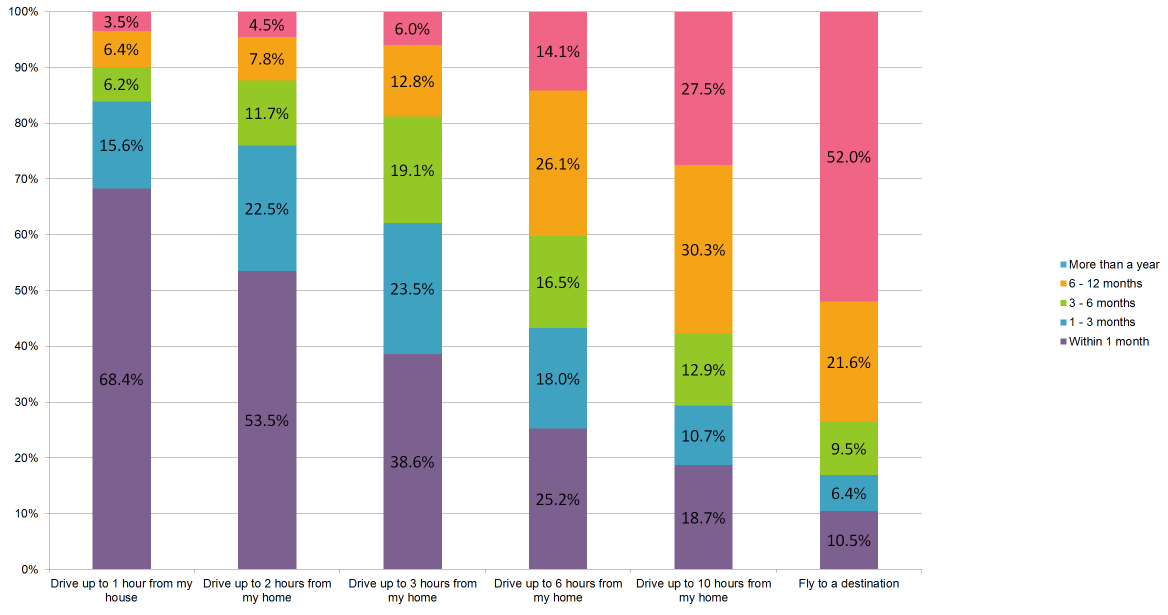

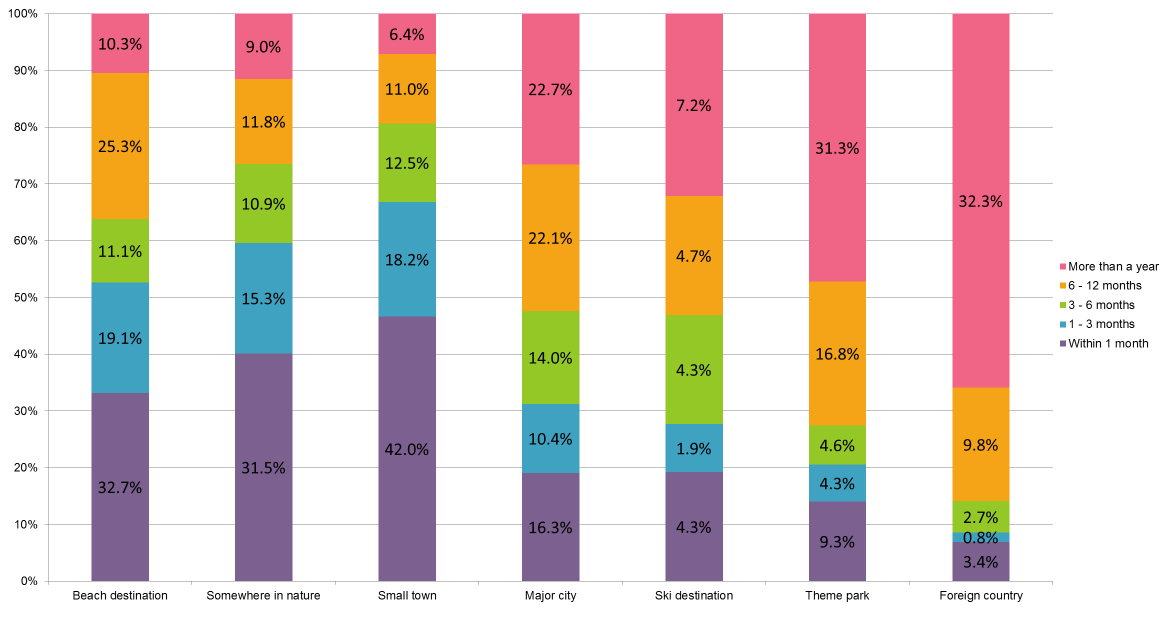

15. How soon will you be willing to make the following trips?

- Observation: Those willing to drive up to an hour from home within 1 month was at 68%, 2 hours, was 54%, and 3 hours was at 39%.

- Data Comparison: Within 1 month, the following were notable changes:

- The 1 hour drive category increased from 53% to 68%!

- The 2 hour category increased from 40% to 54%!

- 3 hours increased from 29% to 39%.

- Opportunity: The 1-3 hour drive market remains the most confident for traveling sooner rather than later. For the near future, targeting these consumers via email and paid search will yield the best returns.

- Resource: Fuel has developed A How-To Guide For Targeting Drive Markets

16. How soon will you be willing to travel to the following types of destination?

- Observation: Destinations with opens spaces continue to far more likely to be visited earlier than densely populated areas, or high-touch destinations. The small town category has continued to grow in popularity, now far-outpacing the beach and other places in nature

- Data comparison: All categories saw increases in the 30 day window, but small town saw the largest shift, going from 32% to 42%. Even major cities saw a bump, going from 12% to 16%.

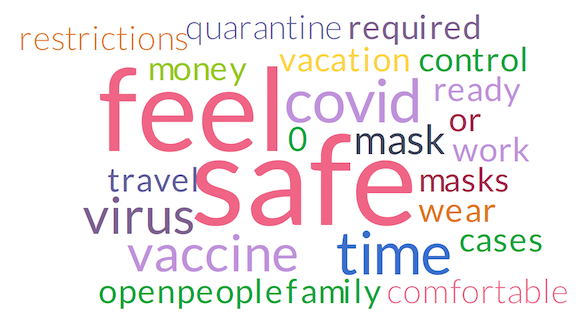

17. Complete the following sentence: I will travel when:

- Observation: “Feel safe” is most prevalent since we first asked this question. Phrases relating to a vaccine, number of virus cases declining have also been popular.

- Data Comparison: We did not see much change since the last survey. “Mask” and “masks” returned again.

- Opportunity: As mentioned before, whatever you can do to assure visitors that you have their well-being as a priority will increase your chance in convincing them to stay with you. Being cognizant of the financial stress many people are feeling, and providing value-add items to packages where possible will help consumers feel more comfortable booking.

Wrapping it Up

We have now been sending out these surveys for over 5 months. In this time, respondents have been consistently sending the same message: they care about their health safety.

The level of comfort in traveling has shifted again, increasing rather dramatically in the past month. 50% of respondents have now traveled during the pandemic. As school opens again, and the pandemic continues to change on a weekly basis, we would continue to expect more changes in sentiment. Making the most of the 1-3 hour drive market, including tactics to promote last-minute stays, is a must. Properties need to be doing all they can to let potential guests know that they are looking out for everyone’s safety (which seems to be happening), as well as communicating information about the surrounding area (which seems to be where properties are lacking).

Survey Methodology

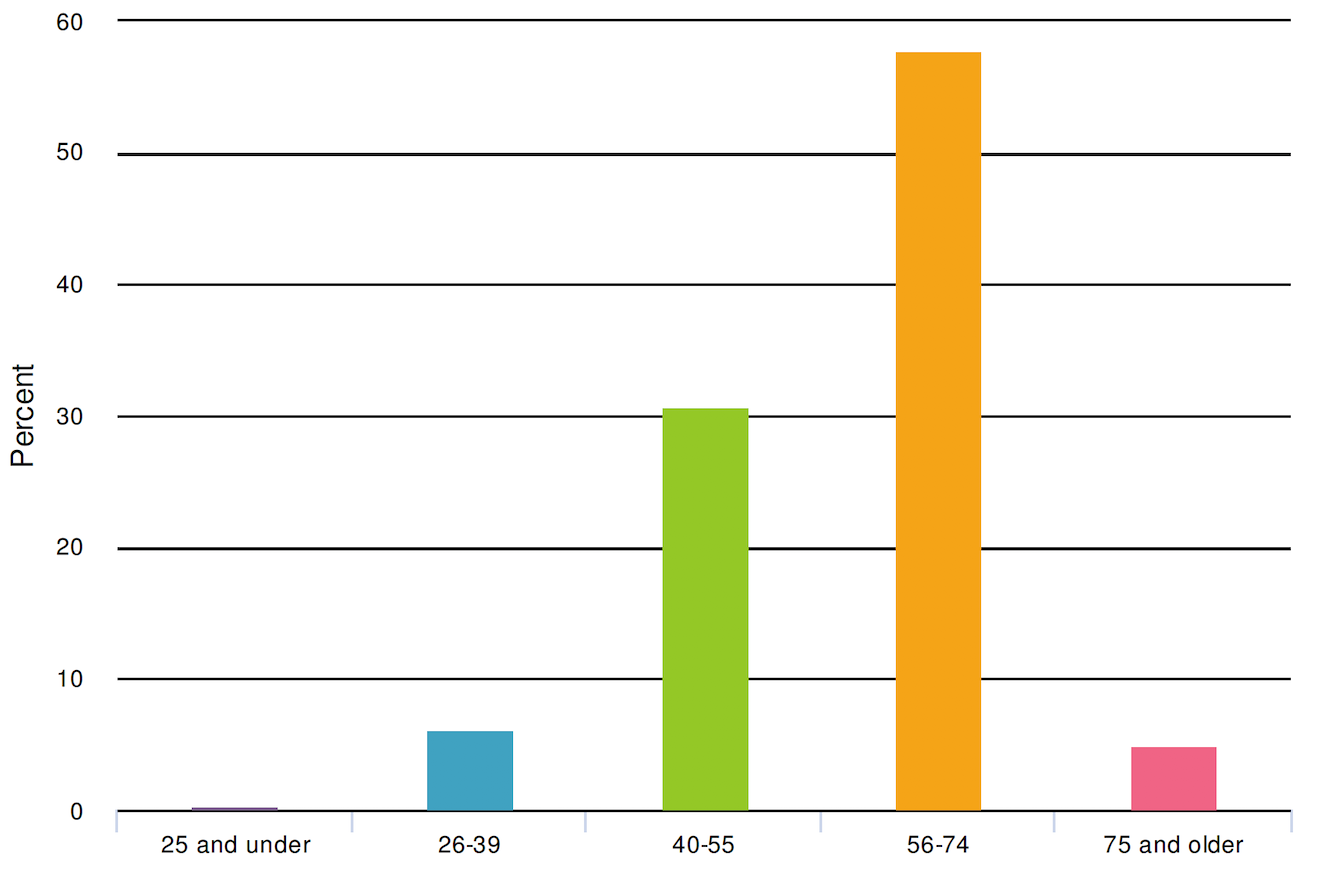

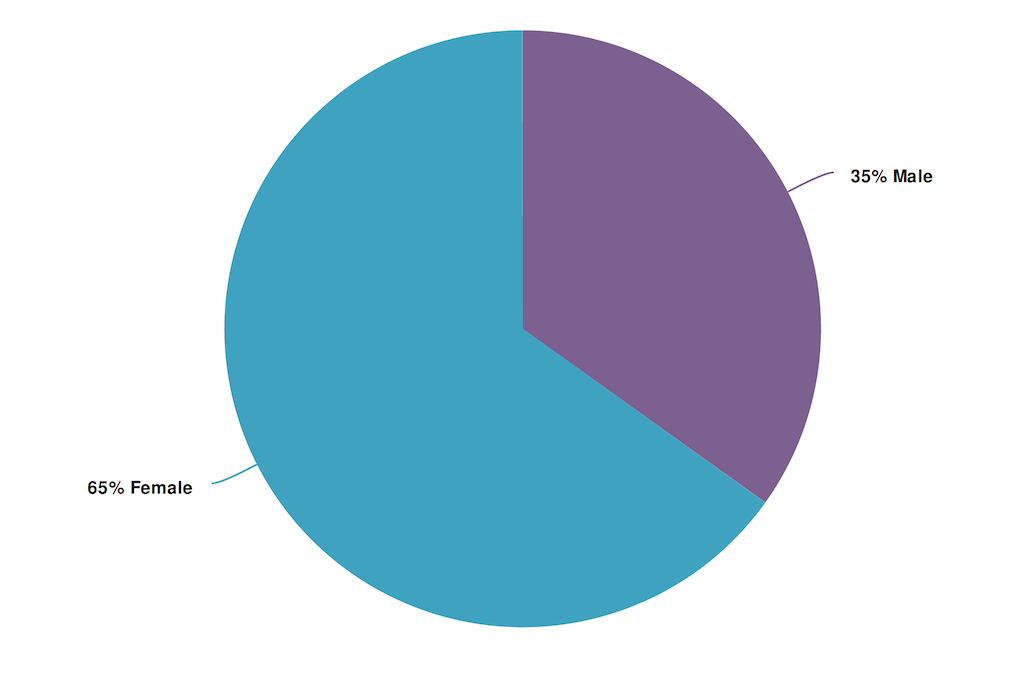

This was a self-reporting survey sent to a database of leisure travelers located in North America. Questions containing multiple checkbox responses had the options randomized to avoid positional bias. 1,400 respondents completed all questions.

Below is the demographic breakdown of respondents.

Age & Gender:

Do you have children living at home with you?

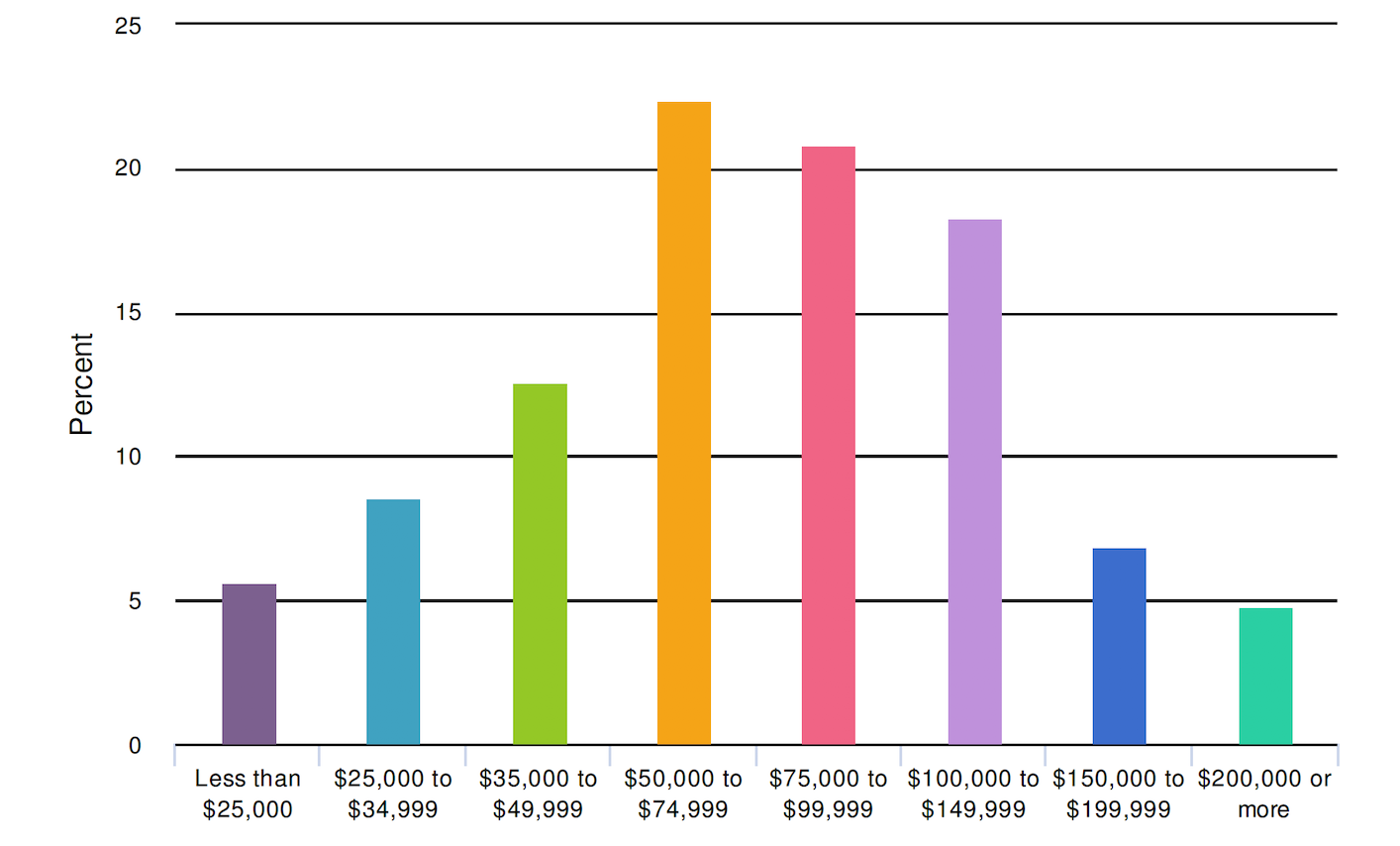

What was your total estimated household income before taxes during the past

12 months?